The procedure of posting entries from a cash book to ledger accounts has been explained in a single-column cash book article. The same procedure is followed for posting entries from double as well as triple column cash books to ledger accounts. The cash and bank columns of a triple-column cash book are used as accounts and are periodically totaled and balanced, just like in the case of a double-column cash book.

Blockchain in Accounting Questions? Answers.

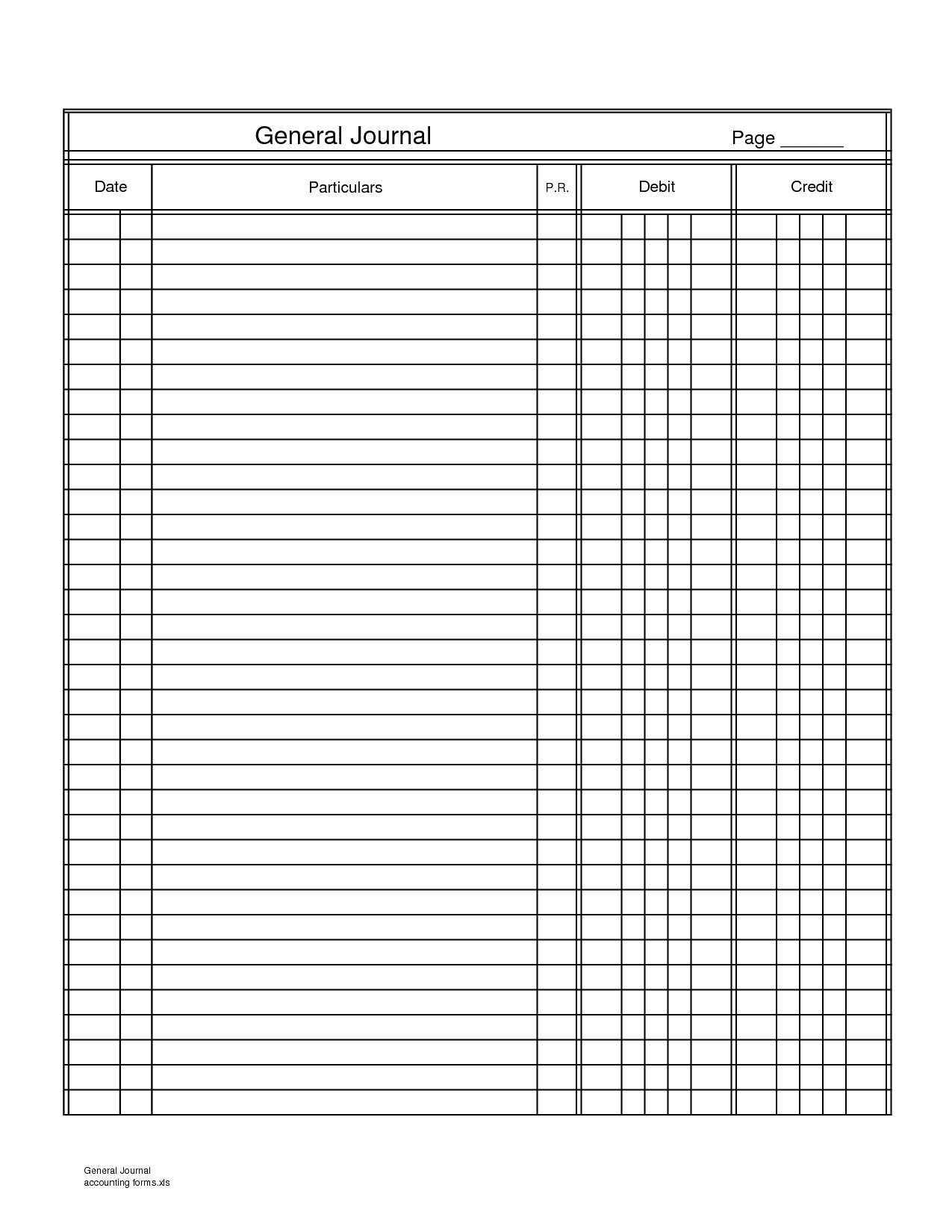

Much like journal entries are currently recorded in an organization’s subledgers (e.g., Accounts Receivable) and general ledger, recording transactions on a blockchain would provide visibility into related transactions. In the general ledger, two separate accounts are maintained for discount allowed and discount received. The total of discount column on the debit side of the cash book represents the total cash discount allowed to customers during the period and is posted to the discount allowed account maintained in the ledger.

Posting a three column cash book to ledger accounts

- In layman finance terms, a blockchain is a digital ledger of all cryptocurrency transactions.

- Bitcoin, Ethereum, and Litecoin are all examples of blockchain currencies.Blockchain currencies are decentralized, not subject to government or financial institution control.

- The discount columns on both receipt and payment sides are only totaled and not balanced.

- At a high-level, triple-entry accounting is an alternative method of accounting in which a third component is added after the global standard debit and credit.

Every participant on a blockchain has a secure copy of all records and changes, so every user can see the provenance of the data by sharing all records. A blockchain database is decentralised, replicated and shared; it is a distributed ledger. The following example summarizes the whole explanation of the triple-column cash book given above. Auditing issues arise where constructionof the books derives from the receipts,and normalisation issues arise when areceipt is lost. This was derived simply fromone of the high level requirements, that of beingextremely efficient at issuance of value.

Patterns of Transactions

Blockchain technology was first proposed in 1991 by a group of researchers who wanted to create a system that would allow electronic documents to be timestamp-verified. However, it wasn’t until Bitcoin launched in 2009 that blockchain finally found its first real-world application. Actually, we simply transferred the amount from receivable to cash in the above entry.

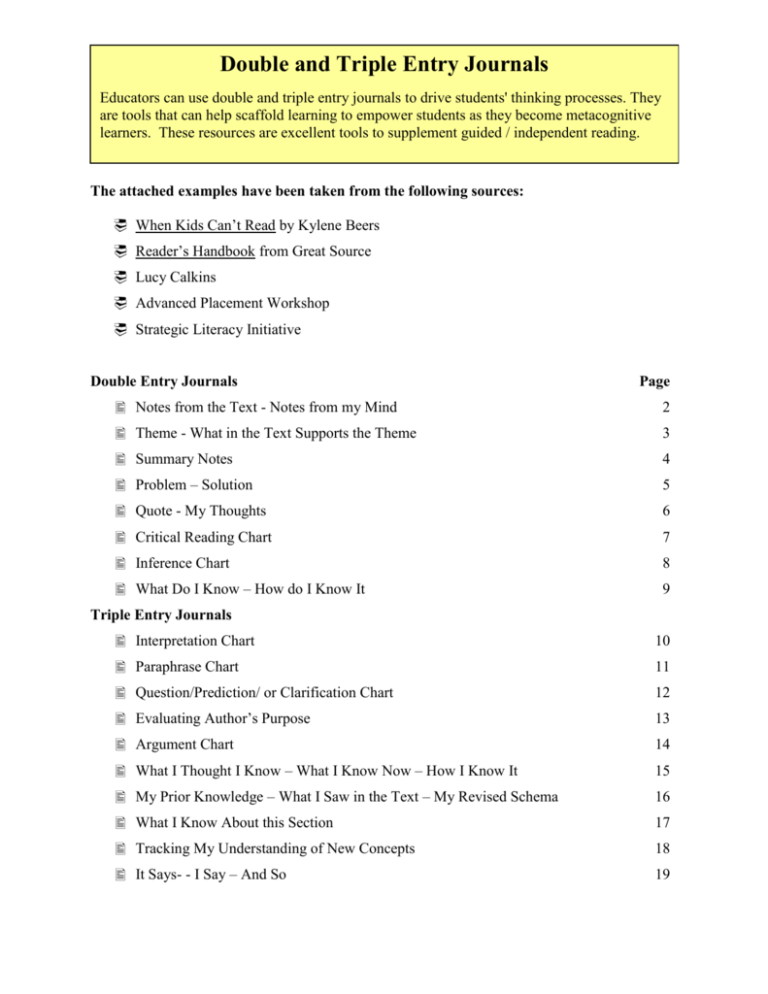

Journal entries: More examples

However, accounting professionals and academic researchers lack adequate training on blockchain concepts and infrastructures. They hence do not possess sufficient knowledge and skills for effective engagement. On the other hand, for Blockchain to transform business processes (including accounting), blockchain experts will need more support from the accounting profession and finance professionals regarding specific business and accounting knowledge.

What are the advantages of triple-entry accounting?

So what we now see is that massive amount of administration could be removed if we had an economy-wide accounting system. This will result in producing two corresponding and opposite entries to two different accounts, always resulting in an equal adjustment to assure the ledger is in balance. This is always the case except for when a business transaction only affects one side of the accounting equation. For example, if a restaurant purchases a new delivery vehicle for cash, the cash account is decreased by the cash disbursement and increased by the receipt of the new vehicle. This transaction does not affect the liability orequity accounts, but it does affect two different assets accounts.

For account titles, we will be using the chart of accounts presented in an earlier lesson. [4] A substantial part of the programming and design was conducted by Edwin Woudt (first demo, SOX layers, UI) and Jeroen van Gelderen (message passing client architecture). [TB] A draft form of this paper credited Todd Boyle as an author, but this was later withdrawn at his request due to wider differences between the views.

Triple-entry accounting allows us to reconcile the balance of transactions and reporting processes so the organizations can trust their own books. The idea about triple-entry accounting is instead of each firm having their own books, the transaction will go through a software program running autonomously which includes everything about that transaction. This may triple journal entry record what the product was, the prices, who the seller is, who is the buyer is, all digitally signed. This can also have a hash that links to further public documents so the books are now linked together by this third entry. The other exciting aspect is that this third entry could also be potentially be viewed for external reviewing or auditing purposes.